INDUSTRY GROWTH, CHALLENGES, AND THE ROAD AHEAD

The Indian machine tool industry is experiencing growth in production and consumption, but exports are struggling while imports are rising. The Government policies and global economic conditions will play a crucial role in shaping the industry’s future.

Indian key economic indicators showed a mixed trends in January 2025 with the Services PMI moderated to a 26-month low of 56.5, while the Manufacturing PMI increased to a six-month high of 57.7, indicating a slowdown in the services sector while the manufacturing sector saw a positive uptick during the month.

Meanwhile, the Index of Industrial Production (IIP) growth dropped to a three-month low of 3.2 percent in December 2024 from 5.0 percent in November 2024 due to moderation in the growth of manufacturing output. In 3QFY25, IIP growth was higher at 3.9 percent as compared to 2.7 percent in 2QFY25.

Monetary Policy and Inflation Trends

In its February 2025 monetary policy review, RBI lowered the repo rate for the first time since May 2020 by 25 basis points to 6.25 percent. CPI inflation eased to a five-month low of 4.3 percent in January 2025, whereas core CPI inflation remained steady at 3.7 percent for the fourth successive month, while WPI inflation decreased marginally to 2.3 percent in January 2025 from 2.4 percent in December 2024.

Fiscal and Trade Performance

Fiscal indicators also indicate a positive picture, with the Government of India's (GoI) Gross Tax Revenue (GTR) showing a growth of 10.48 percent with growth in direct taxes at 12.2 perceny and that in indirect taxes at 7.4 percent during April-December FY25.

India’s merchandise trade deficit reached to US$ 23 billion in January 2025 from US$ 21.9 billion in December 2024. Merchandise exports showed a contraction for the third successive month at -2.4 percent in January 2025 while growth in imports increased to 10.3 percent in January 2025 from 4.9 percent in December 2024. The IMF projected global growth at 3.3 percent in 2025 and India’s growth is projected to remain stable at 6.5 percent in FY26.

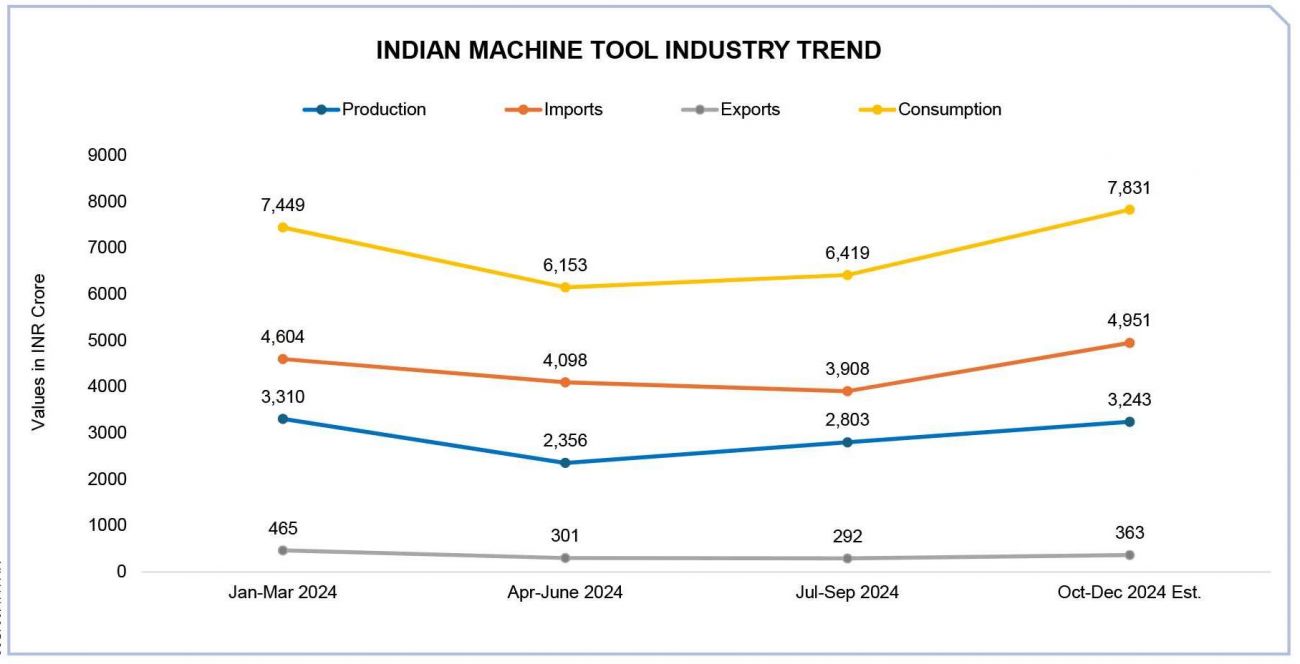

The Indian Machine Tool industry production in CY2024 increased by about 6 percent year-on-year, reaching INR 11,712 crore (US$ 1.4 B). The industry’s imports in CY2024 saw a rise of 23 percent year-on-year, amounting to INR 17,561 crore (US$ 2.1 B). Machine tool exports during CY2024 from India reported a -8 percent degrowth on a low base, amounting to INR 1,421 crore (US$170 M) and consumption is estimated to have increased by 17 percent to reach INR 27,852 crore (US$ 3.3 B) in CY2024.

|

In CY2024, the Indian machine tool industry’s imports saw a rise of 23% year-on-year, amounting to INR 17,561 crore and exports reported a -8% degrowth on a low base, amounting to INR 1,421 crore. |

Key Trends in Machine Tool Imports and Exports

In CY2024, China (27%), Japan (19%), and Germany (12%) emerged as the top countries for imports to India, contributing to 58 percent of the total machine tool imports. Presses (17%), Cylindrical Grinding Machines (11%) and Turning Centers (10%) were the top machinery types imported, valued at INR 6,739 crore (US$ 805 M), constituting approximately 38 percent of total machine tool imports during the period.

While for exports, Russia (22%), UAE (10%) and USA (7%) emerged as the top three export destinations, accounting for 39 percent of total machine tool exports in CY2024, with a total export value of INR 561 crore (US$ 67 M). Turning Centers (19%), Vertical Machining Centers (15%), and Presses (13%) were the top three machinery types exported, valued at INR 664 crore (US$ 79 M), constituting approximately 47 percent of total machine tool exports during CY2024.

Source: IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe