Navigating Shifts

Here’s delving into key economic indicators and getting a comprehensive overview of the Indian machine tool sector’s performance during the first half of FY25.

In December 2024, Real GDP (Gross Domestic Product) and GVA (Gross Value Added) growth eased to a seven-quarter low of 5.4 percent and 5.6 percent, respectively, in Q2 FY25. The Manufacturing PMI (Purchasing Managers’ Index) expanded at a slower pace of 56.5 while that the services PMI remained nearly stable at 58.4 in November 2024 as compared to their levels of 57.5 and 58.5, respectively, in October 2024. IIP (Index of Industrial Production) growth increased to 3.5 percent in October 2024, up from 3.1 percent in September 2024, driven by improved growth in manufacturing and electricity output.

Growth and Inflation Trends

On the inflation front, CPI (Consumer Price Index) inflation eased to 5.5 percent in November 2024 from 6.2 percent in October 2024 as vegetable prices eased, whereas core CPI inflation remained steady at 3.7 percent for the second successive month. WPI (Wholesale Price Index) inflation moderated to 1.9 percent in November 2024 from 2.4 percent in October 2024, primarily due to a sharp fall in vegetable inflation. The Monetary Policy Committee (MPC) chose to retain the repo rate at 6.5 percent in its December 2024 review.

Revenue and Expenditure Insights

During April-October FY2024, Government Tax Revenue (GTR) showed a growth of 10.8 percent with growth in direct taxes at 11.1 percent and that in indirect taxes at 9.0 percent. Total expenditure during the same period showed a low growth of 3.3 percent, with revenue expenditure growing by 8.7 percent and capital expenditure contracting by (-)14.7 percent. However, fiscal and revenue deficits stood at low levels of 46.5 percent and 52.2 percent as proportions of their annual Budget Estimates.

Trade Dynamics

In the external sector, merchandise exports turned negative at (-)4.8 percent in November 2024 from 17.2 percent in October 2024 partly attributable to easing global economic activity. While merchandise imports surged to a 27-month high of 27.0 percent in December 2024 primarily due to a sharp increase in gold imports. The merchandise trade deficit surged to a historic high of US$ 37.8 billion in December 2024, and the average global crude price fell to US$ 72.3/bbl. in November 2024. The OECD (Organization for Economic Co-operation and Development) has projected global growth at 3.2 percent in 2024, with India’s FY25 growth forecasted at 6.8 percent. IMF (The International Monetary Fund) is forecasting global growth at 3.2 percent and India’s growth at 7.0 percent in 2024.

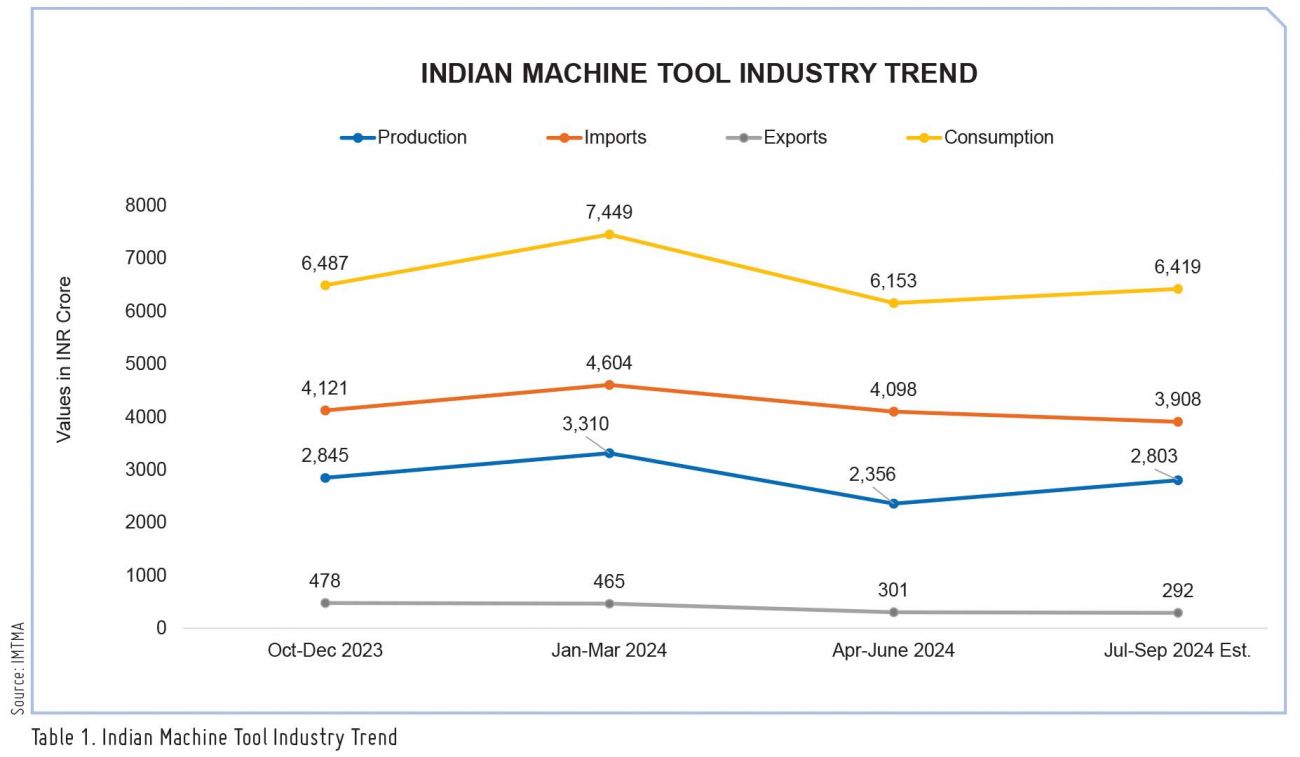

Production, Imports, and Exports Trends

Production for the April to September quarter of 2024 (H1FY25) increased by 6 percent year-on-year, reaching INR 5,159 Cr (US$ 617 million). Orders booked during the same period were INR 6,025 Cr (US$ 721 million) a decline of -13 percent. The industry's imports in H1FY25 is INR 8,006 Cr (US$ 958 million), an increase of

21 percent year-on-year. Machine tool exports during H1FY25 is INR 593 Cr (US$71 million) a decline of -17 percent. Consumption is estimated to have increased by 17 percent to reach INR 12,572 Cr (US$ 1,504 million) in H1FY25.

Total machine tool imports reported from April to November 2024 reached INR 11,004 Cr (US$ 1.3 billion), with 27,001 units of machines imported. China (27%), Japan (16%), and Germany (13%) emerged as the top countries for imports, contributing to 44 percent of the total machine tool imports. Presses (17%), Lathes (11%), and Cylindrical Grinding Machines (10%) were the top machinery types imported, valued at INR 4,240 Cr (US$ 506 million), constituting approximately 39 percent of total machine tool imports during the period.

Total machine tool exports from April to November 2024 amounted to INR 835 Cr (US$ 100 million), with 4,087 units exported. Lathes (21%), VMCs (15%), and Presses (8%) were the top three machinery types exported, valued at INR 373 Cr (US$ 45 million), constituting approximately 45 percent of total machine tool exports during the same period.

Article source: Data & Policy Team, IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe