Accelerating Innovation and Navigating Generative AI

KPMG 2024 Industrial Manufacturing and Automotive CEO Outlook, based on the views of 240 leaders in the sectors, finds that CEOs are generally optimistic, with their eyes turning toward a growth agenda. The report explores that new technologies, including traditional and generative AI, hold enormous potential that could be integrated into Industry 4.0 approaches. An extract…

The economic picture may be shadowed by uncertainty, but industrial manufacturing and automotive CEOs are sure that embracing innovative technologies including AI, and embedding them deeper into manufacturing and assembly processes — which are already transforming as Industry 4.0 takes hold — is a path towards future growth and productivity. Indeed, we see an interesting shift when comparing 2024’s survey results to 2023, with a higher proportion of CEOs saying they are placing more capital investment in technology and fewer prioritizing investment in workforce skills and capabilities. This is especially the case for industrial manufacturing, with the balance more equal in automotive. Overall, the balance between the two sides of the technology/skills investment equation is 58-42 percent, compared to 55-45 percent in 2023. It will be interesting to see whether this is a trend that continues in future years.

|

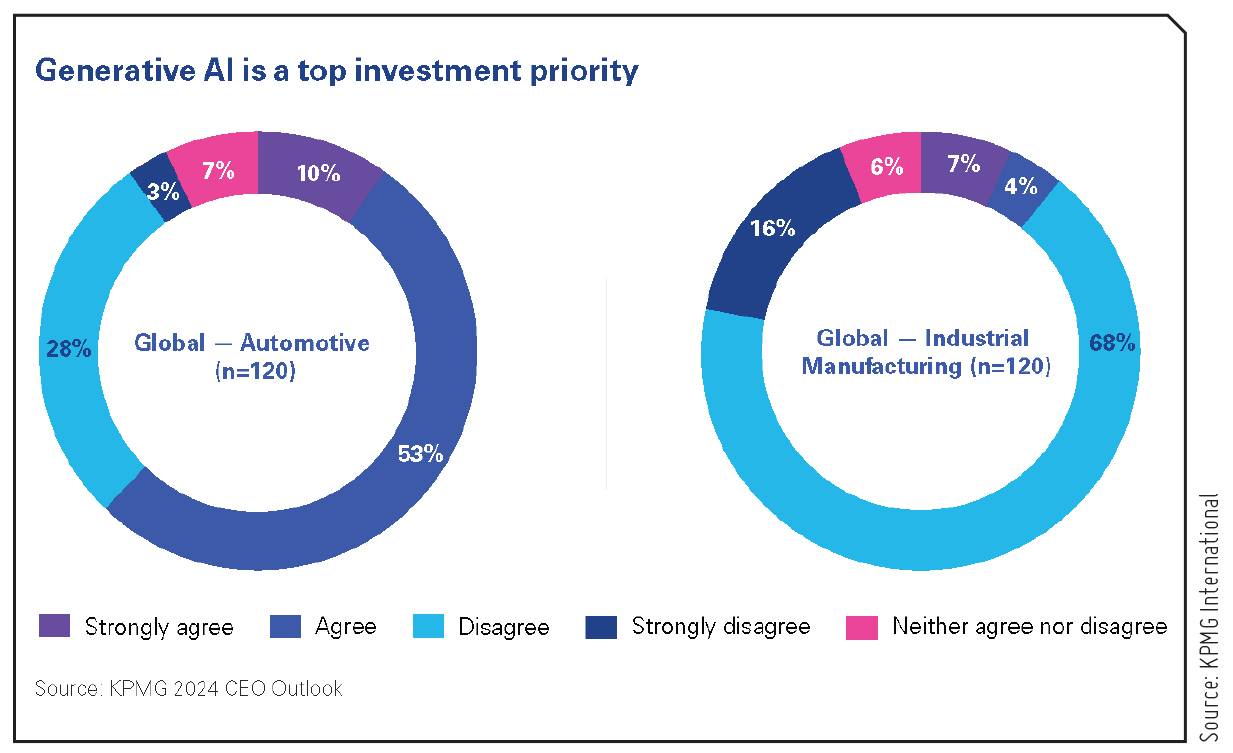

Gen AI has certainly captured widespread boardroom attention across industries and sectors — and within Industrial Manufacturing and Automotive, it is a top investment priority for 37 percent of CEOs. |

Adopting Gen AI

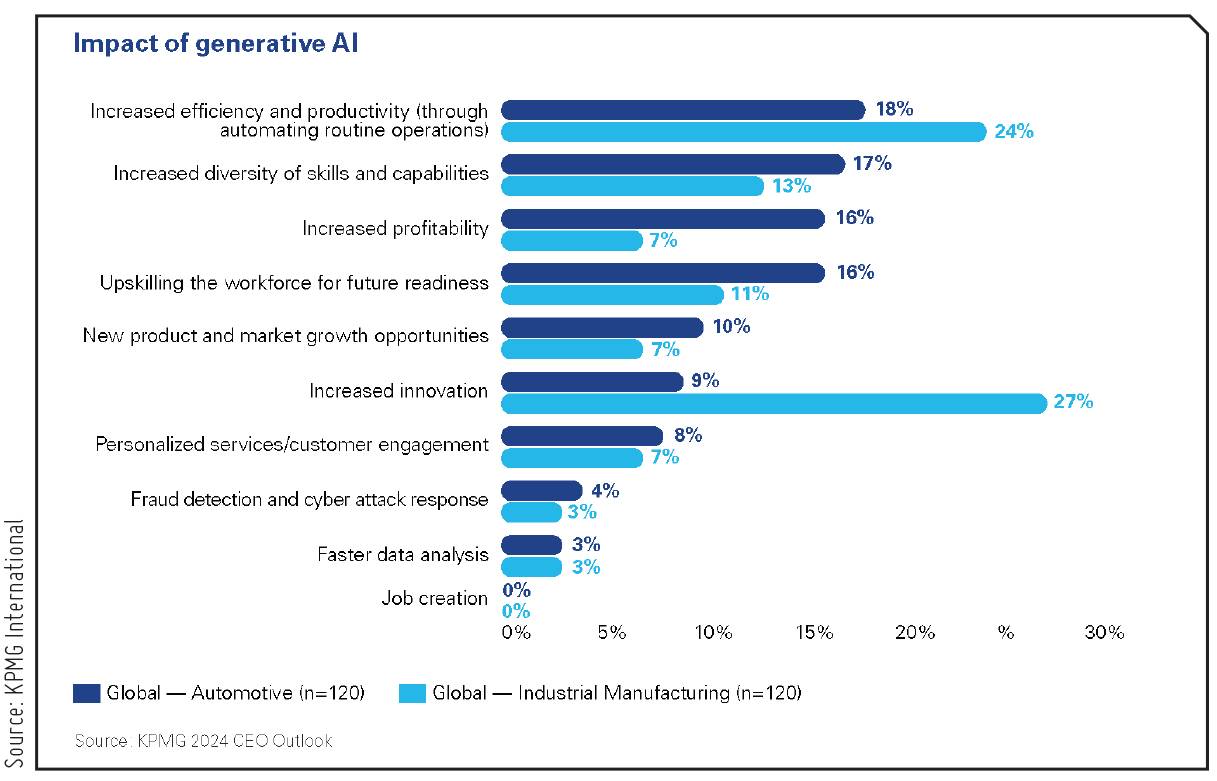

Nevertheless, there is no doubt that CEOs realize AI can only have a full impact if staff are confident and enabled to use it. Investment in upskilling is therefore a key area as this is essential for unlocking the increased efficiency and productivity that CEOs anticipate being the biggest benefit of adopting new technologies like Gen AI.

|

|

Gen AI has certainly captured widespread boardroom attention across industries and sectors — and within Industrial Manufacturing and Automotive, it is a top investment priority for 37 percent of CEOs. However, this is an area where we see some divergence between the two sectors, with Gen AI being a much bigger priority investment area for Automotive CEOs (63 percent) than in Industrial Manufacturing where the majority (68 percent) are neutral. In Automotive, implementing Gen AI also stands out as an operational priority to help achieve growth objectives over the next three years, much more so than in Industrial Manufacturing.

However, CEOs are entering into this with their eyes open and not expecting immediate returns. The great majority (65 percent) only expect to see ROI from Gen AI in a 3-5 year timeframe. They are also highly cognizant of the challenges and barriers involved with Gen AI such as ethics, regulation and costs, as referenced earlier. Two thirds of CEOs feel that regulation needs to move quickly to provide clarity, as a slow pace of regulatory progress will be a barrier to their organization’s success. An even bigger proportion (73 percent) believe that the degree of AI regulation should be proportionate, mirroring that for climate commitments.

While in some respects CEOs feel that their organization is primed for AI adoption, in other ways there is much more to do. On the positive side, 76 percent of CEOs agree that leadership has a clear view on how Gen AI will disrupt business models and create opportunities and 77 percent are clear on how it can help them create competitive advantage. However, only 60 percent say they have robust governance frameworks in place, only 41 percent are confident that their staff have the right skills, and only four in ten say they have their data ready to integrate Gen AI safely and effectively.

|

On the positive side, 76 percent of CEOs agree that leadership has a clear view on how Gen AI will disrupt business models and create opportunities and 77 percent are clear on how it can help them create competitive advantage. |

Time to Appoint a Chief AI Officer?

|

|

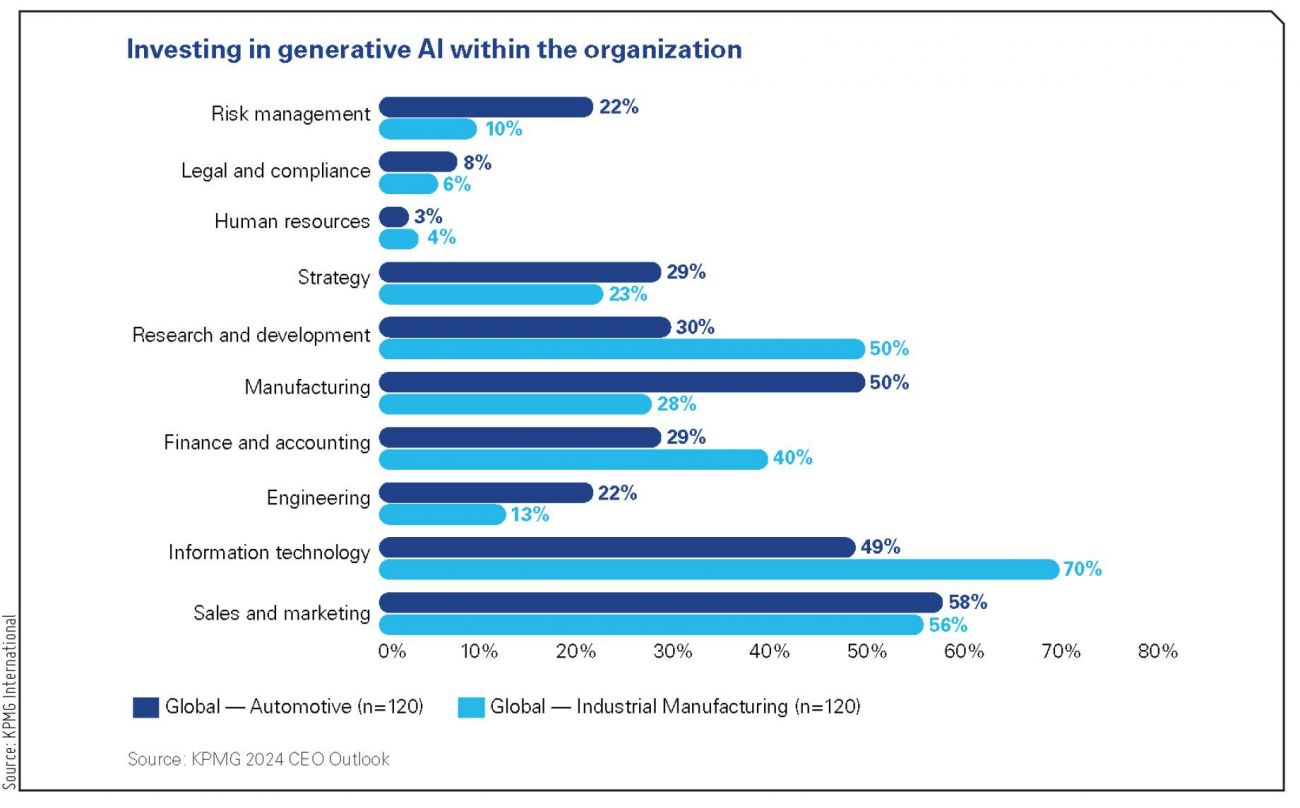

The highest proportion of CEOs (60 percent) flag the IT function as the biggest area in their businesses for Gen AI adoption, but sales & marketing is not far behind (57 percent) while manufacturing is a key area for automotive specifically (50 percent), and research & development is seen as another domain ripe for its use (40 percent) — suggesting a wide range of potential use cases across the enterprise.

Given all of these moving parts, a sound model for AI adoption based on trust, ethics, and governance is essential, as set out in KPMG’s Trusted AI framework.

Source: KPMG International

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe