Indian Auto Component Industry Grows 11.3 Percent to US$ 39.6 Billion in H1 FY24-25

New Delhi, India – Automotive Component Manufacturers Association of India (ACMA), the apex body representing India’s Auto Component manufacturing industry, announced the findings of its Industry Performance Review for the first half of fiscal 2024-25. The turnover of the automotive component industry stood at INR 3.32 lakh crore (US$ 39.6 billion) for the period April to September 2024, registering a growth of 11.3 percent over the first-half of the previous year.

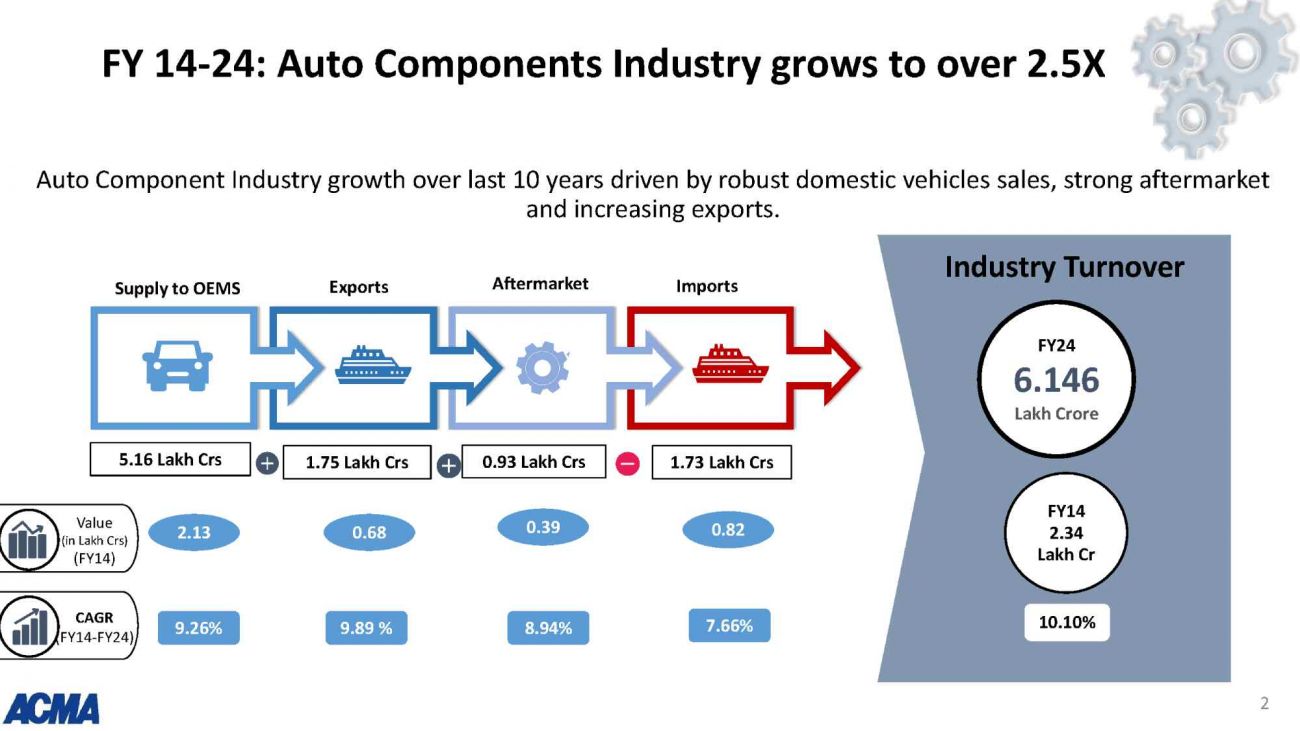

Commenting on the performance of the auto component industry in India, Vinnie Mehta, Director General, ACMA, said, “With vehicle sales and exports displaying steady performance, the auto component industry demonstrated a growth of 11.3 percent, scaling a turnover of INR 3.32 lakh crore (US$ 39.6 billion) in the first-half of FY 2024-25. Auto Component supplies to all segments of the industry, i.e., to OEMs, Exports, and also the aftermarket remained steadfast. Exports grew by 7 percent to US$ 11.1 billion (INR 93.34 lakh crore), while imports grew by 4 percent to US$ 11 billion (INR 92.05 lakh crore), with US$ 150 million in surplus. The Aftermarket, estimated at INR 47,416 crore, also witnessed a growth of 5 percent. Component supplies to OEMs in the domestic market grew by 11.2 percent to INR 2.83 lakh crore.”

Sharing insights on the performance of the auto component industry, Shradha Suri Marwah, President, ACMA & CMD, Subros, said, “With vehicle sales across all segments reaching pre-pandemic levels and despite geopolitical challenges on the exports front, the auto components sector witnessed a steady growth in both domestic and international markets in the first-half of FY2024-25.”

Elaborating on the mood of the industry and outlook for the near- to mid-term future, Marwah mentioned, “The festive season brought significant sales across most segments of the vehicle industry. However, reflecting on the past eight months of this fiscal year, while two-wheelers have shown promising growth, sales of passenger vehicles (PVs) and commercial vehicles (CVs) have been relatively moderate. On the exports front, with geological challenges, delivery time and freight costs have once again gone up. That said, in value terms, the industry remains in robust health, signaling stability and resilience amidst evolving market dynamics. The components industry continues to make investments for purposes of higher value-addition, technology upgradation, and localization to stay relevant to both domestic and international customers.”

Key findings of the ACMA Industry Performance Review for H1 2024-25:

- Sales to OEMs: Auto Component supplies to OEMs, in the domestic market, at INR 2.83 lakh crore (US$ 33.8 billion), grew 11.2 percent compared to the first-half of the previous year. Consumption of increased value-added components and shift in market preference towards larger and more-powerful vehicles continued to contribute to the increased turnover of the auto-components sector.

- Exports: Exports of auto components grew by 7 percent to US$ 11.1 billion (INR 93,342 crore) in H1 2024-25 from US$ 10.4 billion (INR 85,870 crore) in H1 2023-24. North America, accounting for 31 percent of exports, saw an increase of 8.3 percent, while Europe also accounted for 31 percent; however, exports stayed at the previous year’s level. Asia, accounting for 22 percent, witnessed 10 percent growth.

- Imports: Imports of auto components grew by 4 percent from US$ 10.6 billion (INR 87,425 crore) in H1 2023-24 to US$ 11.0 billion (INR 92,050 crore) in H1 2024-25. Asia accounted for 65 percent of imports, followed by Europe and North America, with 27 percent and 7 percent, respectively. Imports from Asia grew by 5.5 percent, and from Europe by 3.2 percent; however, they declined by 8.3 percent from North America.

- Aftermarket: The aftermarket in H1 2024-25 witnessed a growth of 5 percent to INR 47,416 crore (US$ 5.7 billion) from INR 45,158 crore (US$ 5.5 billion) in H1 2023-24. With the increase in e-commerce, the aftermarket is witnessing enhanced penetration, especially in the hinterland, and a gradual evolution into the organized sector.

Image Source: Automotive Component Manufacturers Association of India (ACMA)

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe