German Machine Tool Sector Faces Declining Orders and Rising Short-Time Employment

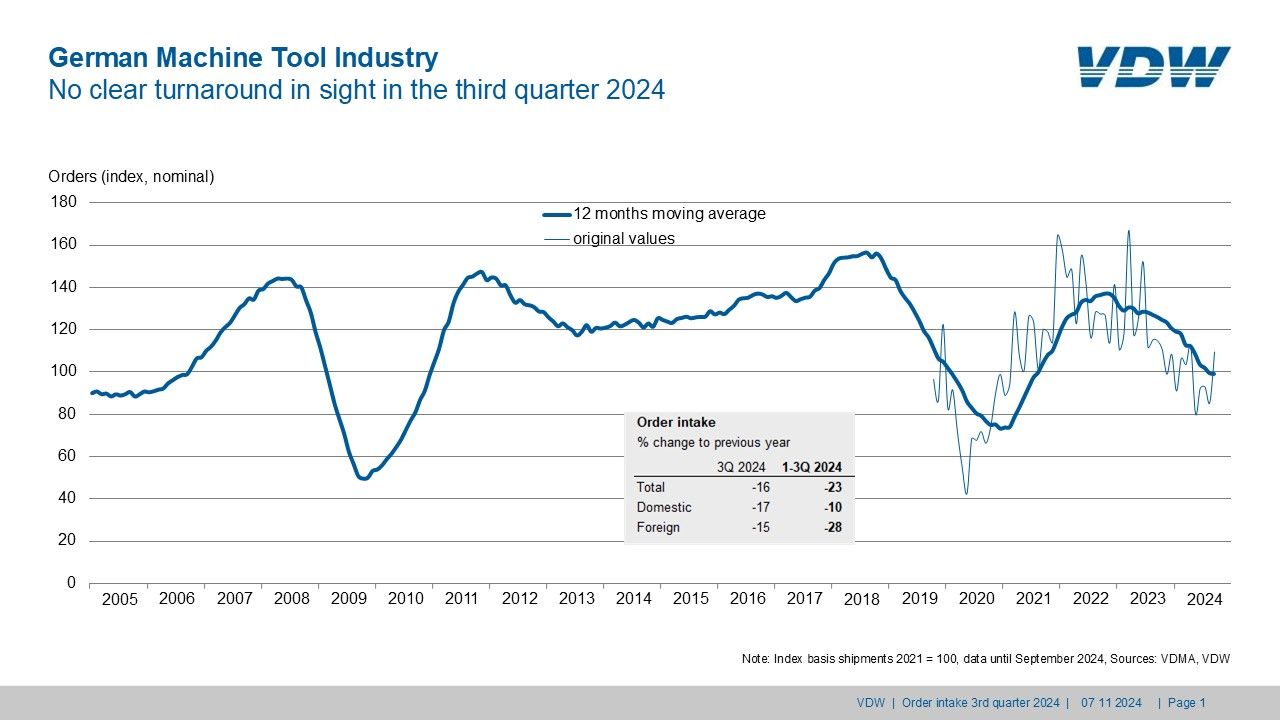

Frankfurt am Main, Germany – German machine tool industry’s orders received in the third quarter of 2024 were 16 percent down on the same period last year. Orders from Germany fell by 17 percent, whereas those from abroad dropped by 15 percent. Orders received in the first three quarters of 2024 were 23 percent down on the same period last year. Domestic orders were 10 percent lower. Orders from abroad were 28 percent below the previous year’s figure.

“The order situation remains challenging,” says Dr Markus Heering, Executive Director, VDW (German Machine Tool Builders’ Association) in Frankfurt am Main, commenting on the result. German industry performed comparatively well in the first nine months of the year, supported by a number of major individual projects. “In general, however, domestic customers are very unsettled and are unwilling to invest,” says Heering. This is dragging down the domestic European market as a whole, as Germany is the most important trading partner for many countries. The other ‘triad’ regions have also lost ground. Asia is most badly affected due to the weak demand from China. There is still no improvement in sight here. The smallest decline has been posted in America. The US and Mexico in particular have propped up demand.

“We have seen little change in the state of the industry since the first half of the year,” states Heering. “The stream of news coming from the automotive industry is giving cause for concern. And overall business levels are down across the board, both in the markets and in the customer industries. A number of major projects from the aerospace, medical technology, energy, shipbuilding, and defense sectors are helping,” he reports. Outperforming the new machine business at present are services, components, repairs, maintenance, and conversions. Automation remains a key driver of machine tool investment in the sector.

According to association surveys, significantly more machine tool manufacturers are planning to reintroduce short-time working in the near future. 35 percent of respondents were considering this in the second quarter, with the figure rising to 45 percent in the third quarter. There are also plans to reduce the numbers of temporary workers. At the end of the first half of the year, the sector employed around 65,250 people.

The production forecast for the year as a whole remains unchanged: a decline of 8 percent.

Image Source: VDW

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe