In Pursuit of GROWTH

India’s ambitious defence modernization programs are a key driver of growth in the Ammunition industry. The modernization efforts are backed by financial commitments, including a significant allocation of the defence budget to capital expenditures. The Government’s initiatives to promote defence production and export play a pivotal role in this context, aiming to increase domestic production and reduce reliance on imports.

The Indian Ammunition industry is on a fast track to grow. In the current defence budget, 27.67 percent of the total was allocated for capital acquisition. Self-reliance is a significant growth driver, propelling the industry towards greater independence and enhanced capabilities. The Indian Government’s ‘Atmanirbhar Bharat’ initiative underscores this focus by prioritizing domestic production and reducing dependency on imports.

In the positive indigenization list released to date, there are approximately 85 items that have been identified by Ministry of Defence (MoD) to be indigenized by 2034.

Market size

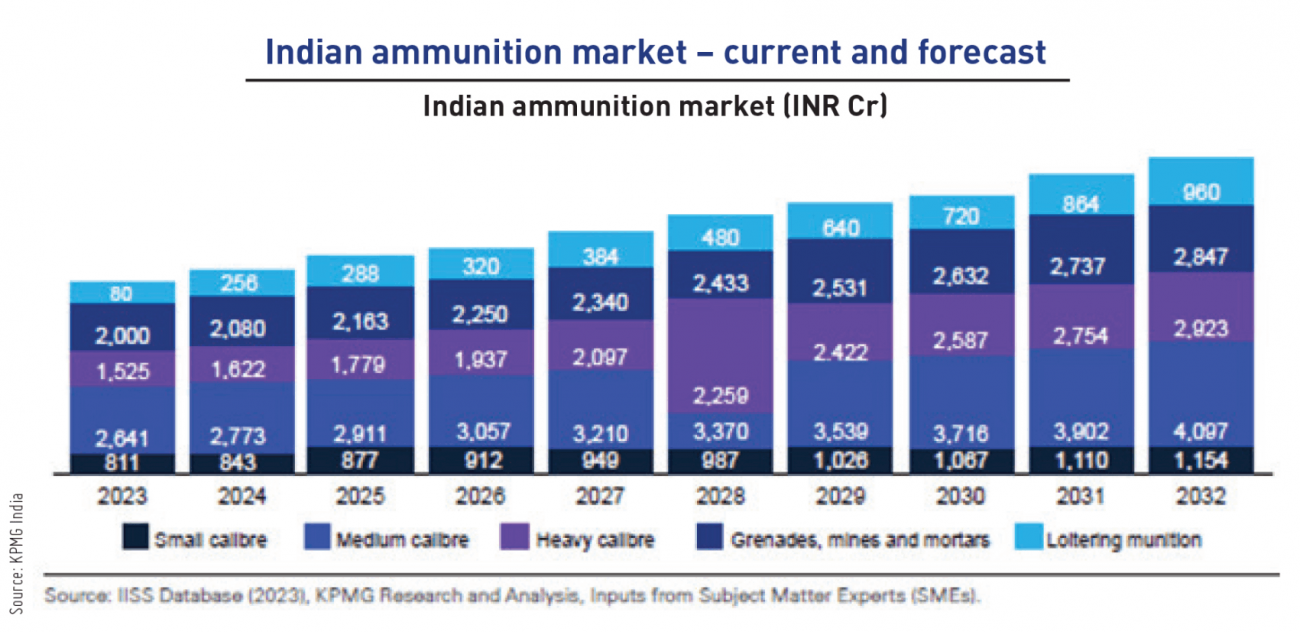

Given that the Indian ammunition market is witnessing substantial growth, the current market is estimated to be worth INR 7,057 crore (US$ 844.0 M) in 2023, which is about 5.5 percent of the global Ammunition industry. A majority of this market comprises medium calibre closely followed by grenades, mines, and mortars.

Over the period 2023-32, the market is anticipated to increase at a CAGR of 4.93 percent to INR 11,981 crore (US$ 1.4 B) – a number that is 6.5 percent of the global Ammunition industry over the same period. This indicates that the Indian ammunition market is going to grow faster in comparison to the global demand.

The chart provides a detailed breakdown of the Indian ammunition market’s growth components based on the calibre-wise segmentation. In 2023, the small calibre ammunition market in India was around INR 811 crore (US$ 97.1 M) and it is expected to rise to INR 1,154 crore (US$ 138.1 M) by 2032, showing a rise of 42 percent. This number is expected to increase to 225 million units by 2032 with Armed Forces accounting for 85 percent of the consumption. The demand for medium calibre ammunition in India was estimated at INR 2,641 crore (US$ 316.1 M) in 2023 and is expected to grow to INR 4,097 crore (US$ 490.4 M) by 2032, showing a rise of 55 percent. The demand for medium calibre ammunition is spread across all the wings of the Indian military.

| With the policy underscoring the importance of reducing dependency on foreign suppliers, and boosting in-house capabilities, India is emerging as a notable exporter of defense equipment, with key markets in Southeast Asia, the Middle East, and Africa. |

Overview of ammunition imports and exports

| India’s Defence sector, characterized by an influx of foreign investments and rapid technological advancements, has seen shifts in its imports and exports strategy. Historically, the country has been reliant on importing military equipment, including various types of ammunition from countries such as Russia, the United States, France, etc. However, recent years have witnessed a concerted push towards self-reliance, underlined by the ‘Make in India’ initiative. With the policy underscoring the importance of reducing dependency on foreign suppliers and boosting in-house capabilities, the country is emerging as a notable exporter of defense equipment, with key markets in Southeast Asia, Middle East, and Africa. |  |

Import

In 2023-24, India imported ammunition of INR 837 crore (US$ 100.1 M) in terms of value and 4.7 million rounds in volume. In terms of small calibre, the Defence Public Sector Undertakings (DPSUs) are capable to meet the domestic demand, but in the case of medium and heavy calibre, there is a prominent dependence on European and Russian countries for Import. With respect to advanced technology ammunition i.e., the precision-guided ammunition, there is almost 100 percent dependence. However, owing to the indigenization push, we have seen a decline in imports in the last couple of years, and the Indian defence establishment is striving to become self-reliant as well as a net exporter of ammunition in the next 1-2 years.

Export

In 2023-24, India exported ammunition of INR 1,230 crore (US$ 147.2 M) in terms of value and 4.7 million in volume. Increased focus on indigenization in the Defence sector under the ‘Make in India’ policy is enabling increased participation from private players in terms of ammunition manufacturing. The major portion of export involves small calibre ammunition and associated components (machined) of the various calibre.

The Indian ammunition industry has traditionally been dominated by government-owned entities namely DPSUs. Despite their significant contribution, these organizations have faced legacy issues such as outdated technology, inefficiencies, and supply chain constraints, limiting their ability to meet demands. This has catalyzed the need for a more dynamic and responsive production ecosystem.

|

In response to the increasing demand and supply-demand gap, the sector has seen a surge in investments from both domestic and international players. Liberalization of defence production policies and initiatives like ‘Make in India’ has played a crucial role in attracting private sector participation. Until October 2022, the MoD has issued close to 600 industrial licenses for defence manufacturing to private companies – 1/5th of which have been for the manufacture of guns and cartridges – and cumulative Foreign Direct Investment (FDI) in the Defence sector has reached INR 5,077 crore (US$ 607.7 M) until 2024. These investments have facilitated the entry of global entities and enabled numerous joint ventures aimed at enhancing domestic production capabilities. |

Challenges and opportunities

The Indian Ammunition industry, despite its growth, faces several significant challenges that hinder its full potential. Regulatory complexities, technological deficiencies, and reliance on imports for essential components are among the primary obstacles. These issues not only impede progress towards self-reliance but also affect the competitiveness of the sector. However, addressing these challenges head-on can pave way for substantial improvements and innovations.

Technological hurdles

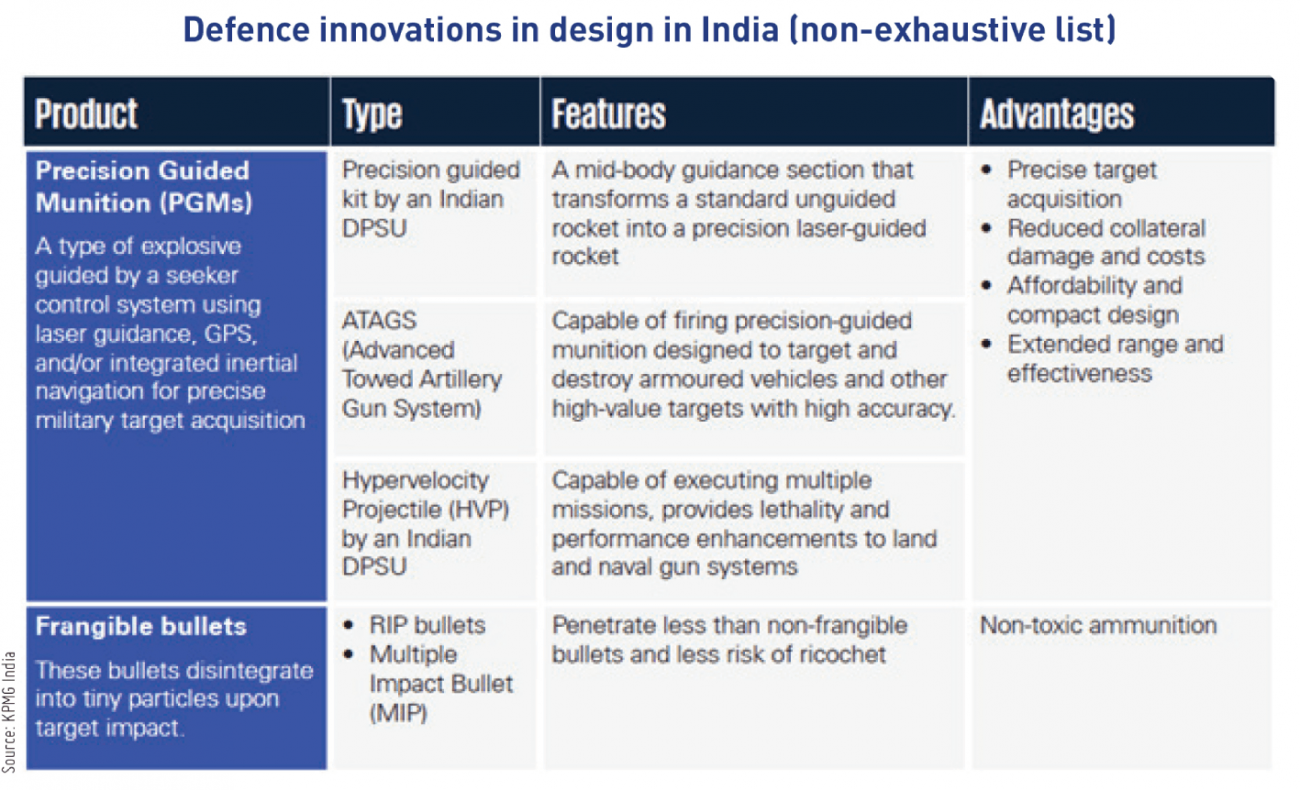

India has made good strides in technological advancements, particularly in design innovations which are bringing greater sustainability and improved performance in ammunition production. Despite these achievements, the Indian Ammunition industry, like many of its defence counterparts, faces technological challenges across different calibre segments.

To address the broader spectrum of technological challenges, specific R&D hurdles must be overcome. While technological advancements are crucial, the foundation for these innovations lies in robust R&D efforts. Addressing these challenges requires overcoming several critical obstacles, including:

- Substantial costs and a high gestation period to see the benefits of R&D have not encouraged private industry from investing in R&D initiatives.

- India needs to develop expertise in designing critical components for advanced munitions, including smart and precision munitions.

- Need to push infrastructure and qualified human capital to support R&D initiatives.

- Lack of competition within Indian R&D agencies.

| In 2023-24, India exported ammunition of INR 1,230 crore (US$ 147.2 M) in terms of value and 4.7 million in volume. Increased focus on indigenization in the Defence sector under the ‘Make in India’ policy is enabling increased participation from private players in terms of ammunition manufacturing. |

Supply-side constraints

Supply-side constraints in the Indian Ammunition sector pose significant challenges, impacting the industry’s ability to meet the growing demand for advanced and reliable ammunition. These include:

Input material availability: In India, there is no production of Antimony, a raw material used for making small arms and bullets. The entire requirement is met through the import of ores and concentrates. The country is not self-sufficient in the production of copper ore – a crucial component in the manufacturing of bullet cartridges — and also in the production of iron ore, an important element that can withstand high pressures and temperatures generated during firing. Limited production of Toluene, a raw material necessary for making TNT, is also a challenge. Large-scale production of Toluene requires significant infrastructure and technology that Indian industry does not possess. Additionally, there are limited producers of primers and propellant powder in the country.

Manufacturing: Owing to proprietary manufacturing techniques as well as quality concerns, a significant portion of medium calibre ammunition is imported by India.

Quality: Low-quality products result in failure rate and delays in orders being placed.

Regulatory barriers

Navigating policy-related obstacles is pertinent for the growth and efficiency of the Ammunition industry. A few of the specific regulatory challenges are as mentioned below:

Procurement: L1-based procurement is one of the biggest challenges for private sector companies. Limited tenders/cancellation of ammunition procurement tenders pose challenges. Procedural delays in terms of conversion of a requirement from Acceptance

of Necessity (AoN) to Request

for the Proposal (RFP) stage to the final selection of the vendor is

another deterrent.

Licensing and certifications: The application process for an industrial license required for ammunition manufacturing has a long turnaround time and is not completely transparent. The quality and safety certification process is a time-consuming process.

Export: Procedural delays result in uncertain timelines. Ammunition being a part of the SCOMET list, poses certain restrictions in terms of export items.

Way forward

As the Indian Ammunition industry strives to overcome its current challenges, it is essential to chart a strategic path forward:

International collaboration

India’s Defence sector has witnessed greater international collaborations in recent years. These partnerships exemplify the growing trend of international collaboration, aimed at leveraging foreign expertise and technology to bolster India’s defense manufacturing capabilities, which can be replicated in the Ammunition industry.

Moreover, such a collaboration is vital for the transfer of technology (ToT) in the industry, despite supply-side challenges. Though concerns around Intellectual Property (IP) rights exist, international partnerships can address technological and supply-chain issues by providing access to advanced technologies and establishing reliable procurement networks.

| In the Union Budget 2024-25, expenditure on R&D increased by INR 358 crore, an increase of 3 percent over 2023-24. The budget is reserved for industry, startups, and academia to support collaborative projects involving private companies and academic institutions. |

Technological capabilities

To address technological challenges, companies must invest in R&D to innovate and keep pace with global advancements. The Government should create attractive incentives for foreign players to invest, along with access to local resources, which would make India a more appealing destination for international ammunition manufacturers.

In the Union Budget 2024-25, expenditure on Research and Development increased by INR 358 crore, an increase of 3 percent over 2023-24. The budget is reserved for industry, start-ups, and academia to support collaborative projects involving private companies and academic institutions. For instance, India’s premier defense research entity could form partnerships with the private sector to co-develop advanced ammunition-related technologies. These collaborations can accelerate the development of cutting-edge solutions, enhance technological capabilities, and create a robust ammunition ecosystem.

Source: KPMG India and FICCI

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe