Going the Electric Way

The article highlights the significant shift towards EVs in India, the opportunities and challenges that ensue this transition, and the crucial role of automation in manufacturing battery packs to ensure efficiency, safety, and scalability.

One of the latest trends in the Manufacturing industry today in India is electric mobility (E-Mobility). This gradual shift towards electric vehicles (EVs) largely impacts the Auto industry. Most internal combustion engine (ICE) vehicle OEMs are cautiously navigating this technological disruption.

The transition from fossil fuels to electric batteries has brought about notable changes in the manufacturing landscape of automobiles. The reduction from about 1,000 moving parts in an ICE vehicle to just about 200 parts in an EV impacts much more than what meets the eye. This disruption is challenging established manufacturing companies, governments, our lifestyles, and how we imagine our future to be.

Evolution of battery technology

Electric vehicles are not new; in fact, the first e-vehicle was built in Europe in the 19th century. The battery technology was then in its infancy and chemical engineers were struggling with battery technologies to provide higher speeds, longer ranges, safety, and convenience. Meanwhile, mechanical engineers were working hard on the ICE and refining it for better efficiency. However, the ICE had to be cranked manually. This shortfall was addressed by electrical engineers who introduced the starter motor. This made the ICE the preferred choice due to its reliability and convenience.

|

Opportunities in the Indian EV market

The battery technology has advanced by leaps and bounds and is today at a mature stage, providing longer ranges and safety, though there is more to come. Every disruption is also a huge opportunity, as is the case today. The Indian EV market is estimated to be about US$ 100 billion by 2030.

The Government estimates an employment potential of 1 crore direct jobs and another 4-5 crore indirect jobs. It is also staggering to consider that 90 percent of passenger vehicles (PVs) globally could be electric by 2050.

Expanding the supply chain ecosystem

Established ICE vehicle manufacturers are refurbishing and repurposing their existing infrastructure to handle EVs, while large EV manufacturers are bullishly eying the market in India. This shift has given a new direction to design and development professionals in the Auto industry. The supply chain ecosystem in India is enlisting new players every day for batteries, motors, chargers, power electronics, charging infra, swapping, recycling, etc. Eventually, if India wants to make its mark on the global EV map, it needs a robust and reliable supply chain ecosystem.

The pole position is already taken by China which has sold about eight Mio e-cars in 2023, contributing about 40 percent to the total car sales in the country and leaving behind Europe and North America. In contrast, only 90,000 cars have been sold in India in 2023.

Adaptation of EVs in the Indian market

India is also a very adaptive market where technology can be easily adapted and proliferated to address genuine needs that are not addressed by the establishment. In 2023, the highest-selling EVs in India were not the self-owned PVs but 3-wheelers tailored to carry about six passengers at least. Most of them were sold in the state of Uttar Pradesh.

|

| Festo has been involved in the end-to-end automation of battery packs for EVs – both PVs and 2-wheelers. Precision handling of battery cells for testing, welding, and packing has been accomplished using its portfolio of products. |

The market for e-PVs calls for consolidation, standardization, infrastructure, shared resources, and efficient manufacturing. Skateboard designs are now moving towards standardization and the battery pack is integrated into the chassis frame, providing structural strength and a lower center of gravity for better road grip. This means body builders can buy these skateboards over which they can build vehicles to suit applications, including passenger vehicles, food carts, school carriers, goods carriers, etc. The future for EVs in India seems exciting with auto majors like Tata Motors Ltd, Mahindra & Mahindra, Hyundai Motor Company, MG Motor, etc. all announcing their launches of new vehicles for the next two years.

Detailed anatomy of an EV

Let’s look at the EV anatomy in perspective. The skateboard is where the EV differs from its ICE counterpart. It contains a Battery Pack, a Hub Motor with a simple transmission, a Rear Hub Motor if the vehicle is a dual motor version, and On-Board Electronics. The onboard electronics feature the rectifier to convert the AC power from the charging socket to DC power required to charge a Traction Battery Pack, a DC-DC converter that regulates the voltage and current required by the motor, and a Battery Management System.

When it comes to evaluating the costs, it is observed that 40 percent of the cost is taken by the battery pack, the motor takes a share of 15 percent, and the onboard electronics, including the charger, take 10 percent. The rest is taken by the other components of the car – the upholstery, the dashboard, lights, etc. This 35 percent may be common to both EVs and ICE vehicles.

Hence, when optimizing the manufacturing of EVs, the need is to focus on the efficient manufacturing of the battery pack and the motor.

Advancements in battery cell technologies

While various battery cell technologies are at various stages of development, it is the lithium-ion technology that has matured to find its place in the present EV vehicles. The cells are available in three forms – the cylindrical cell, the pouch cell, and the prismatic cell.

The supply chain ecosystem for the battery pack is completely dominated by the Chinese companies and it is not surprising that most of today’s manufacturers in India are only engaged in the battery packs with cells imported from China. However, there is a serious effort to do backward integration led by companies like Tata Motor Company and Ola Electric Mobility.

| The pole position is already taken by China which has sold about eight Mio e-cars in 2023, contributing about 40% to the total car sales in the country and leaving behind Europe and North America. In contrast, only 90,000 cars have been sold in India in 2023. |

Automation in battery pack production

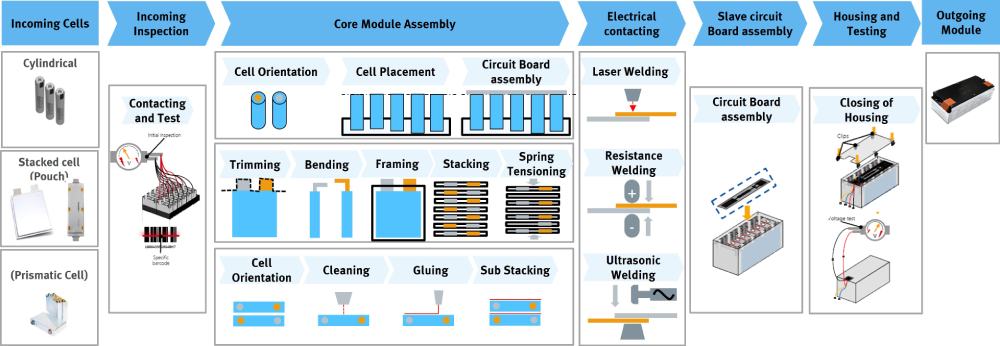

The process of converting battery cells into battery modules and then into battery packs must be automated and scalable in order to be sustainably viable. Battery cells which form the cellular components of battery packs must be stacked, arranged, and tested. Mechanical testing is carried out to test the integrity of the cell for shock, vibration, etc, Electrical testing is carried out to check the resistance, voltage, and current, and lastly, the leak test is conducted to ensure that the cell is leakproof. The tested cells are then assembled and welded to connect them either in serial or in parallel to form a module. A number of modules are then arranged to form a battery pack. The process has intricate procedures to be followed to ensure reliability and safety. This process needs to be entirely automated to handle the volumes and ensure consistency and safety of personnel.

In totality, automation is essential in the production of battery cells, assembly of battery modules and packs, and integration of the battery packs onto the vehicle belly. Dry and clean room conditions with automation components free from Copper, Zinc, and Nickel ensure safe and reliable automation.

Festo has been involved in the end-to-end automation of battery packs for EVs – both PVs and 2-wheelers. Precision handling of battery cells for testing, welding, and packing has been accomplished using our portfolio of products from end-of-the-arm grippers and linear motion modules up to energy-saving modules and cloud connectivity for traceability and diagnostics.

|

RAMESH RAMACHANDAR

|

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe